I’ve been super busy and unable to post, so this will cover the past two months of my finances. I was in China and Singapore for almost all of April, hopefully I get a chance to write about it and post some photos in the coming week.

Budgets

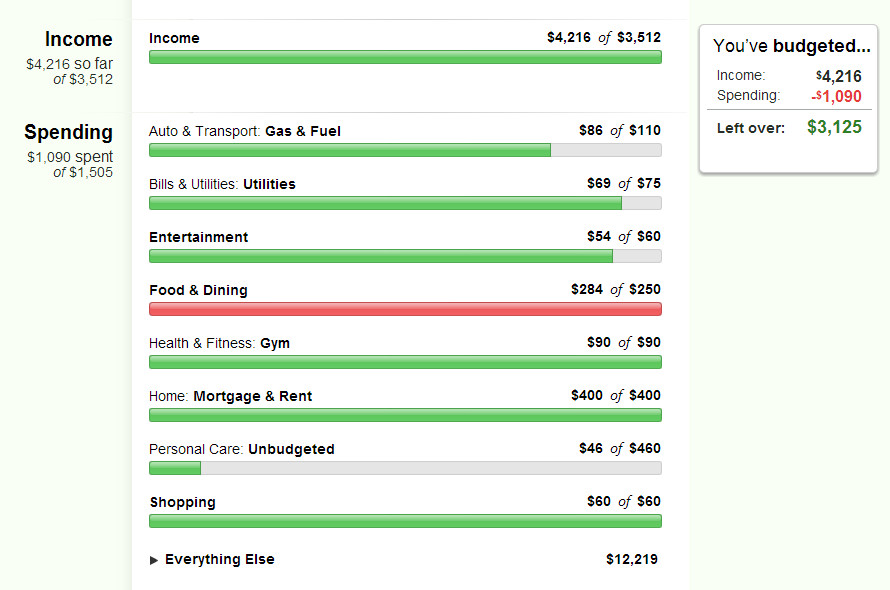

March went pretty well, As always I overspent on food, shopping went a little over due to some random things I wanted/needed for work.

April was an excellent month. This represents the end of my budget cuts over time. My budget is now 1500$, with an “unbudgeted” category to absorb extra spending/unforseen costs, such as dental costs for April and purchasing a nice travel watch for myself. I was in CA for about 5 days in April and spent my entire food budget by going out when I was home, really shows how much damage going out to eat can do! April also shows the addition of my rock climbing gym membership, definitely worth it as long as I’m home enough to go! It’s really fun, a great exercise, and a great opportunity to meet lots of girls that are in shape, haha.

In the long term view of my finances, things are going stunningly well! The following graph shows how my net worth has been steadily increasing over the past year and is now in the positive, words can’t describe how stoked I am! Unfortunately this includes retirement accounts and I still have debt, so still a little ways to go before I am in the green 🙂

For me the most important graph is of my student loan debt:

Again, very positive! My May payment is scheduled for next week, and will total $6,000, bringing me to about 10k in debt remaining, aka 1/3rd of where I was at when I started working. My goal is to pay it off by August 13th, which is the anniversary of when I started working 🙂 The most interesting part of this graph is that it shows that I didn’t get serious about paying off my debt until January of this year, in other words I worked for about 5 months until I was able to start aggressively start paying down my debt. This is an interesting lesson, it means that coming into some money doesn’t mean immediate effects. Over those months I bought a new laptop, had to move twice, got robbed by a roommate, and bought lots of things for travelling for my job. Now I am finally pretty settled financially (except my car is going to die soon enough).

Again, very positive! My May payment is scheduled for next week, and will total $6,000, bringing me to about 10k in debt remaining, aka 1/3rd of where I was at when I started working. My goal is to pay it off by August 13th, which is the anniversary of when I started working 🙂 The most interesting part of this graph is that it shows that I didn’t get serious about paying off my debt until January of this year, in other words I worked for about 5 months until I was able to start aggressively start paying down my debt. This is an interesting lesson, it means that coming into some money doesn’t mean immediate effects. Over those months I bought a new laptop, had to move twice, got robbed by a roommate, and bought lots of things for travelling for my job. Now I am finally pretty settled financially (except my car is going to die soon enough).

Time to start thinking about where I want my life to go…