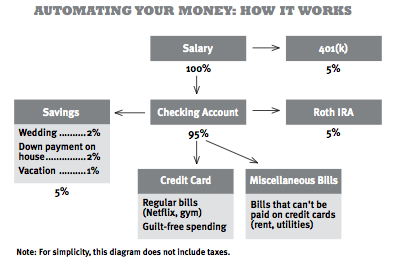

Flow breakdown and budget

Via Tim Ferriss’s website via guest post from Ramit Sethi of IWTYTBR.

Via Tim Ferriss’s website via guest post from Ramit Sethi of IWTYTBR.

Above is a picture of Ramit’s basic finance system. Last year I spent most of my money building up some liquid cash for emergencies, and now I’m finally able to buckle down and lay down the framework for my financial system. Here’s my breakdown:

Salary: 70k before travel bonuses. Shooting for 100k with 50% travel

401k: 6% pre tax, with 3% match from company (match goes straight to company stock if I’m reading correctly). My 6% goes to 20% large, medium, and small cap index funds and 40% international index funds with about a 70 30 split between developed and developing countries.

Roth IRA: Just set it up with 2k for last year (adding another 3k when I can later this month), and 500 auto deposit from checking on the first of the month, starting next month (5500 total which is the max). It is unlikely I will reach the 110k max income for depositing into a roth ira. Roth IRA directly invests in a retirement lifecycle fund (VFIFX).

The rest of my budget is (aka credit card/miscellaneous bills in the above picture):

250 on shopping (also absorbs miscellaneous costs such as motor oil)

162 on gas (includes 1 trip to OC per month)

250 toward entertainment (mostly bars, can also absorb unforseen expenses)

480 for food and dining (high because I eat out a lot due to travel, trying to cut back).

Plus 360 going toward minimum payment on student loans.

Travel decreases how much I spend, but I keep a fixed budget which means I can spend my food/entertainment budget on more shopping or more extravagance.

That covers about 70% of my non bonus budget. Everything else goes to building my liquid cash/emergency fund (currently low), and once those are full, toward paying off my college loans ASAP.

Account breakdown

Checking:

Bank of America normal no fee account: standing balance of 1k, just as a backup.

Schwab High Yield Investor Checking: Holds entire emergency fund of 5k to 10k, primary account that receives money and pays out to credit cards, etc. Earns a ridiculously small amount of interest, but I need to stay liquid due to large expenses for work, otherwise I’d keep 2k in it.

Savings:

ING Orange Savings Account: Only holds 1k, earns so little money, much better to put my money toward my loans which cost me a guaranteed 7%.

Retirement:

401k: Mostly using for match, when I change jobs I can roll it into my Roth IRA. Also using to decrease my taxable income.

Roth IRA: Used to shelter money from future taxes. I was planning to wait until after I paid off my debt, but realized I can withdraw money for my first house when it is needed, so this doesn’t keep me from being too liquid. If I’m buying a second house, I doubt the money in here would matter much to me.

Credit:

Starwood Preferred Guest AMEX: Primary credit card, used to earn points!

BOA Power Rewards card: Used to keep credit line for credit score purposes, and is my primary backup for when AMEX isn’t accepted. AKA my In ‘n Out card.

Citi Thank You card: Kept almost purely for credit score purposes, will be kept alive with a small charge every other month, and acts as a buffer to absorb unforeseen costs (covered a hospital bill for me for a few days).

Loans:

UCI Grad School Loans: 27,000 ish owed at 6%

Outlook

Before I opened my retirement accounts, I had hoped to pay off my student loans by August, but now December 31st seems a worthy goal. My new goal: By December 31st, 2013, owe no money to anyone, have $15,000 principal invested in retirement accounts, and have roughly $10,000 liquid cash emergency fund.

All that’s left to do is change all my billing dates to the first of the month (amex and citi card), contribute 3k to my roth ira for last year. Oh, and get started on travelling 120 days this year 🙂

Leave a Reply